Break Even Calculator

Break Even Calculator

This calculator makes break even analysis fast and easy. Simply enter your fixed business costs, your variable unit costs and your sales price to estimate the number of units you would need to sell to break even. You can also adjust price-points and recompute the needed sales volumes at different prices.

Today's Savings Rates

The following table shows current rates for savings accounts, interst bearing checking accounts, CDs, and money market accounts. Use the filters at the top to set your initial deposit amount and your selected products.

Breaking Even & Strategies to Increase Sales

- Guide Authored by Corin B. Arenas, published on May 18, 2021

Whether you have a large or small company, analyzing the break even point is a crucial part of business finance. Though breaking even may not seem much of a goal, it’s an important standard that tells you when your revenues have covered your expenses. Analyzing break even points provide entrepreneurs with insight into how to manage their company’s production, operations, sales, and even loan repayment strategies.

Our guide will discuss the fundamentals of the break even point and how to calculate this financial benchmark. We’ll talk about different factors that impact breaking even, such as fixed and variable costs. We’ll also discuss how these factors affect unit selling price. Then, we’ll touch on strategies to reduce business costs, as well as different ways you can increase your sales.

What is the Break Even Point?

When your business reaches its break even point (BEP), your company’s revenue is precisely equal to its total estimated business costs. BEP is the level of production at which your total revenue is the same as your business expenses. It means no net profits or losses for a company, it simply “broke even.” BEP is an important milestone that can determine the success or failure of any venture. It’s a sign your business can earn just as your expenses have ended. Above the BEP, every dollar of sales is equivalent to absolute profit.

Thus, companies can only earn when their total revenue surpasses the break even point. That is why BEP is also referred to as the time it takes for a business to become profitable. On the other hand, if you keep earning lesser revenue than your estimated costs, your business will face losses.

In the field of accounting, break even point (BEP) is the requisite revenue amount needed to pay for the total fixed and variable expenses incurred by a business within a specific period of time. BEP could be stated as the necessary number of units sold or hours of services rendered to equal the amount of revenue.

In investing, the break even for a stock or future trade is estimated by comparing the market price of an asset to its original cost. Investors reach the breaking point when the original cost and the market price of the asset are the same. When the market price increases, that’s when investors earn profit.

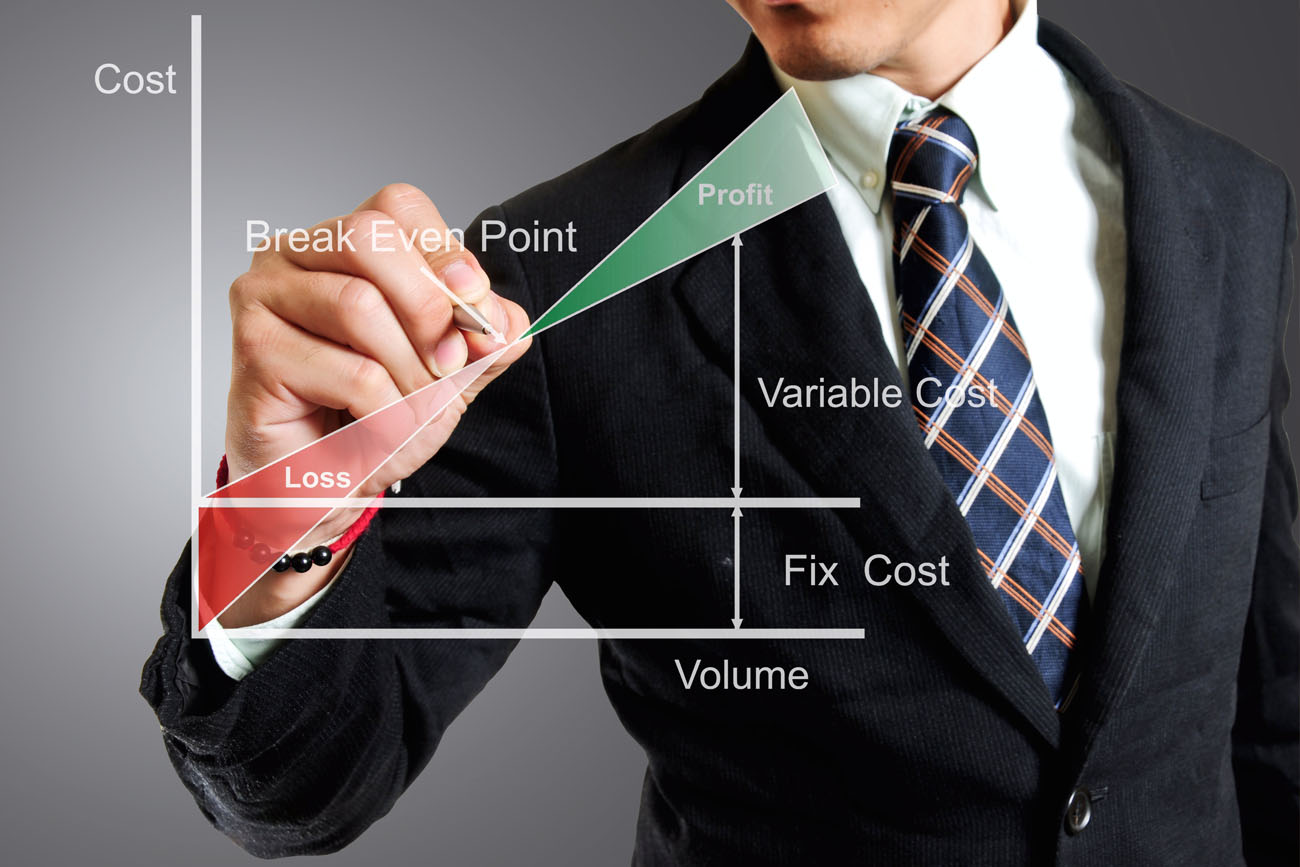

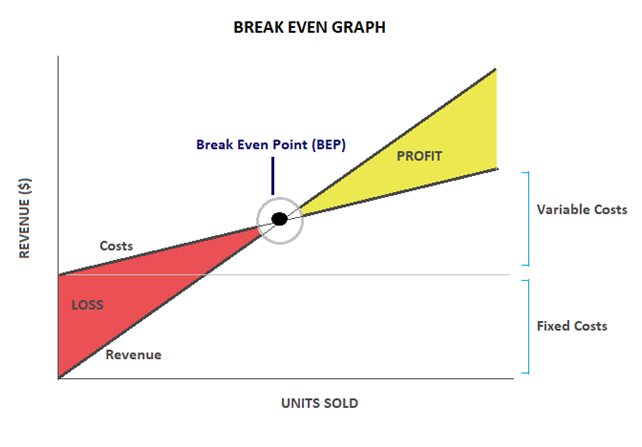

The following graph illustrates how surpassing BEP spells profits for a business.

How Long Does It Take for a Business to Be Profitable?

For small businesses, on average, it takes at least two to three years to become profitable. This is just a standard estimate, which means it varies depending on the type of product or service you are offering. Sometimes, a company can start earning right away, while others may take three years or longer to earn profits. But of course, the sooner you can recoup costs, the sooner you can earn and increase your profits.

Generally, when a company starts to earn is determined by how expensive the startup costs are. The larger initial capital you need upfront, the longer it will take for a company to recoup business expenses and become profitable.

Why is BEP Important?

Breaking even is a crucial point of reference in any business or investment. Analyzing your company’s break even point (BEP) is an essential benchmark that guides your long-term business strategies. In running a company, you must determine BEP for different costs, such as production and operations, loan payments, and sales. This will help you price your products or services at the right level, as well as manage operational expenses efficiently.

Break Even Analysis for Financial Planning

In performing break even analysis, you must determine the number of sales needed to afford all fixed and variable costs for a business. Specifically, it estimates the minimum number of units that must be sold or the sales volume necessary to cover all expenses before your business makes any profit. Performing a break even analysis is especially helpful for the following goals:

1

Knowing your company’s overall BPE helps you obtain a business loan or persuade a potential investor. Lenders and investors will ask about BPE in the financial report section of your business plan.

2

If you intend to sell new products, calculating the BPE allows you to price your product strategically.

3

When it comes to planning your cash flow and profit approach, you can use BPE as references for different products or services you are offering.

Before you can conduct a break even analysis, make sure to look into the following factors:

- Variable Costs: These are costs that typically increase as your production increases, such as materials, labor, shipping, etc. It’s associated with the expenses of making a product or purchasing it wholesale. Specifically, a variable unit cost pertains to the changing cost of producing one unit of a product. Before you can calculate BEP, you must take note of all the expenses that go into producing your product. For instance, if you are baking cupcakes, your variable unit costs include flour, eggs, sugar, fruits (basically all the ingredients). Don’t forget the cost of labor and buying boxes for your orders.

- Fixed Costs: These are expenses that do not change as you increase your production. Fixed costs keep your business operations going even if you’re not generating products. Examples of this include rent or your commercial mortgage, utilities, business insurance, and the salary of administrative employees (those not producing the product). It also includes any commercial loans you made. Fixed costs may also factor the expense of patenting your product, as well as the cost to design the product and the packaging.

Practical Application & Pricing

For example, let’s say it costs $5 in materials, labor, and other direct expenses to create a product. This means your BEP for creating 1 product is $5. If you generate 1,000 units of that product, your BEP will be $5,000. But this doesn’t include your overhead costs yet. Don’t forget other fixed expenses such as rent, marketing, research and development, insurance, etc.

Suppose your overhead expense is $10 per product, which is $100,000 for 1,000 units. If you generate and sell 1,000 products, your total BEP would be $15,000, which is $15 per product.

On top of this, what if you have a startup loan you need to repay? Let’s say you have a $20,000 commercial loan that you want to pay off in two years. To do this, you must put an additional $10 per unit if you intend to sell 2,000 products in two years. Thus, your BEP selling point will be $25 per product during the first two years.

How does this affect pricing? When you analyze the BEP, you might find that $25 is too steep a price for a new product. Depending on your market, it might not be a competitive price that entices sales. Once you know this, you can adjust your loan repayment to a three-year period instead. This way, you can keep the selling price more reasonable while still paying off your commercial loan.

Now, if you want to pay your $20,000 commercial loan within 3 years, you must add $5 per unit on your product. This reduces your selling price from $25 to $20. The affordable price will be more attractive to consumers. By knowing you’re within your competitor’s price range, you are also not overpricing your product.

Price Setting Implications

Based on the example, when your loan is paid after three years, if all variables remain the same, you can reduce your price to $15 per unit for more competitive pricing. On the other hand, you can keep the same price ($20), which allow you to make more profits per unit.

But in the long run, since consumers tend to prefer affordable products, a lower price point might result in more sales. This could generate higher total profits, even if the profit per product is cheaper. Note that your BEP will change as your sales volume for the product and the unit price changes.

Calculating BEP

To determine the break even point (BEP), you must take the total fixed costs of production, and divide it by each individual revenue minus the variable cost per unit. Again, fixed costs are expenses that do not change based on the number of units sold. When we subtract the variable cost per unit from the revenue (selling price per unit) and divide this by the revenue, this is also known as the company’s gross profit margin ratio. The gross profit margin is expressed as a percentage.

Below is the formula for BEP:

Break even point = Fixed costs / (Revenue per unit – Variable cost per unit)

In this example, suppose Company A’s product has a fixed cost of $60,000. The variable cost per unit is $0.80 cents, and each unit is sold at $2.

Fixed costs = $60,000

Variable cost per unit = $0.80

Revenue or selling price per unit = $2

= 60,000 / (2 – 0.80)

= 60,000 / 1.2

= 50,000 units

The result shows that Company A must produce and sell 500,000 units of its product to pay for their business’s fixed and variable costs. By reaching this number of unit sales, the company has not gained profits yet. It just breaks even on the necessary business expenses. Once Company A sells over 500,000 units, that’s when it will earn profits.

For the next example, let’s say a certain Company B’s fixed costs amount to $1 million. And their gross profit margin is 35%. Here’s how we can calculate BEP.

Break even point = Fixed costs / Gross Profit Margin

*Gross profit margin = (Total Revenue – Variable cost per unit) / Total Revenue

= $1,000,000 / 0.35

= $2,857,142.86

In this example, the BPE is $2,857.142.86 million. This means Company A must earn more than $2.85 million in revenue to pay for the fixed and variable costs of the business. Again, they will only earn profits once they generate higher sales. But if company B continues to generate lower sales, they will incur losses.

Factors That Increase the Break Even Point

We’ve shown how estimating the break even point (BEP) lets us know the minimum target to cover production expenses. But over time, you’ll notice that BEP rises or decreases depending on different market factors. Take note of the following factors that can increase BEP:

1

Increasing Customer Sales – When there’s higher demand, a business must produce more of its products. To meet the higher demand volume, you need to cover larger production expenses. This means adding things like labor and materials costs. As a result, increasing sales also raises your BEP because you spend for extra expenses.

2

Increasing Production Costs – In other cases, demand for your product may remain the same or stay steady. However, the cost of producing your product is likely to increase over time. Note that raw material prices increase with inflation. When this happens, expect your BEP to increase because of the higher expenses. Besides the production costs, other variables such as utilities, rent, and employee salaries will also increase over the years.

3

Production Disruptions – Operational issues that affect your production, such as broken equipment, can increase BEP. Low turnout from your employees may also affect production. Spending for equipment repairs incurs extra costs, which adds to your BEP. Because your target units are not met, you don’t produce enough products within the requisite time period. Without enough products, you won’t break even as scheduled, which increases your BEP.

Strategies that Help Reduce Business BEP

There are ways to lower your BEP to help recoup your expenses sooner. It involves cutting down business expenses to make your operations more efficient. Here are several effective methods to reduce business BEP:

1. Lessen the Variable Cost Per Unit of the Product

One way to decrease BEP is to reduce the variable cost needed to produce a product. This is one of the reasons why many U.S. companies outsource work from different countries. Outsourcing labor from countries such as India, Malaysia, China, and other low-cost countries helps U.S. companies reduce the variable cost of a product. It enables them to sell at more competitive prices while maintaining the quality of their product and hitting profit margins.

But of course, outsourcing labor to cheaper countries isn’t the only solution. If you can find a local supplier that provides a good deal, that’s even better. And if you’ve been working with a supplier for a while, consider negotiating with them. Ask if there’s a way they can help reduce the price of your raw materials. Try to push for lower rates, especially if you’ve been working with them for many years. They just might agree to lower the cost to keep you as their client. If not, you can look for a better deal with a new supplier.

2. Adjust the Unit Selling Price of the Product

Increasing your product price might be the most obvious way to reduce your BEP. But wait right there. Companies should proceed with caution every time they decide to increase prices. More often, it could mean losing a chunk of consumers who purchase your product because of affordability. Before increasing the price, you must conduct surveys and market research. It’s also important to check your competitor's prices and any unique features to their products. But if the market allows it, you can certainly increase your price up to a level that consumers will keep buying.

Consider the following factors before raising your product’s selling price:

- Compare the increased price to its competitors. – You put your product at risk if your new price is a lot higher compared to competitors. Competitors typically stay within a price range, so try not to go beyond this threshold. Moreover, if there are no distinct features in your product despite the higher price, consumers will choose cheaper options. If you are to convince customers to buy at a higher price, your product must have a unique selling point and a higher quality perception in the market.

- How will the new price affect customer behavior? – When the price increases, consider how many consumers will no longer be able to afford the product. When you conduct market research, ask consumers if they will continue to buy your product. If not, which options would they rather choose? If you lose old customers, see if this will significantly offset extra profits you’ll gain from increasing prices.

- Can you add new features at a low cost? – Finally, think of possible ways to improve your product with minimal extra costs. Adding a new feature will justify the price increase to consumers. If you can, try to provide the new feature while offering it at a competitive price. A product with an added feature at the same price point would seem more attractive to consumers.

3. Lower the Company’s Total Fixed Costs

Besides the cost of production, operational expenses are crucial for your business. This involves rent, utilities, and other operational costs. But if you want to lower you BEP, it’s important to assess how much you’re spending on your operations. Take note of expensive and unnecessary costs that you can reduce. You might need to look for a more affordable space to rent, or rethink a more cost-effective marketing strategy. In other cases, you may need to find a new contractor who can give you lower rates for maintenance services. When you’re running a business, finding ways to minimize these costs is crucial in making your business profitable.

According to Chron Houston Chronicle, five of the largest expenses companies spend on include work space, employer payroll contributions, inventory, advertising, and travel.

Work Space

Depending on your company, you might need to rent an office or warehouse to keep your business running. If you’re a new or small business, you’re especially vulnerable to the blow of rental costs. Some landlords may increase rent with very short notice. Try to find a practical space which can accommodate your needs. Establish a clear budget for rent, up to how much you can reasonably afford. During the wake of the COVID-19 crisis, many companies have shifted to telecommuting or remote online work. This eliminated the need to rent office space for many industries.

But as social distancing measures loosen, some companies do consider work space. If you’re not a big firm, you won’t need a space with a conference hall. Things like that can be rented by the hour when you hold an event. It’s also more cost-effective to share restrooms and dining areas with neighboring offices when you’re looking for a professional space.

On the other hand, if you’ve been renting commercial space for a while, try to talk to your landlord. Explain the challenges of maintaining your business, and if they could help adjust your rent. Landlords may actually agree to reduce your rent to keep you for the long-term. This is a better proposition, especially if they know they’ll have a hard time looking for a new tenant. If your landlord won’t adjust your rent, consider looking for a more affordable space for your business.

Employer Contributions to Payroll

Another large expense are employer payroll contributions. Things such as retirement, benefit plans, and health care all add up and increase costs by 50%. This gets more expensive the more staff you employ, and the longer you employ certain personnel. Larger, more stable companies are better able to manage payroll contributions for employees. However, for startups and small businesses, it’s a lot harder to maintain a salary and match their contributions.

If you’re starting a new company, consider hiring staff on a freelance, part-time, or project basis. Once you’re company is firm and stable, you can hire reliable employees into your company on a fulltime position.

Another issue you might face is the inefficient cost of labor. Depending of your business goals, check if your staff is clocking in too much overtime hours. Or perhaps the attrition rate in your workplace is high. When this happens, you’re spending a lot on employees that are not staying long-term in your company. This can drain a considerable fraction of your revenue. To address this, consider training and promoting staff into positions with growth. It’s also important to screen and hire quality employees that would help the business thrive.

Maintaining an Inventory

Small and new businesses tend to find it more challenging to maintain an inventory. It takes time before they learn how much stocks to carry, all while sustaining a level of customer satisfaction. Inventory management for small startups can easily end up in costly storage and inventory insurance expenses. The smaller your business, the more load the inventory has on your cost structure.

On the other hand, large companies find it easier to manage their inventory by using complex tracking tools. Besides using more sophisticated software, they can meet on-time customer demand while keeping just enough products in their inventory. Large businesses can afford to spend on better inventory systems, which in turn greatly improves their services. But even with a small business, it’s crucial to keep your inventory organized. Make sure to prioritize having an efficient inventory software to monitor your goods. You should know the status of your products from production and storage, all the way to delivery and retail. A reliable inventory system also informs you when your products tend to sell well throughout the year. The better you can provide goods on demand, the faster you can reach your BEP.

Excess Advertising

Ads and marketing can take a considerable chunk from your revenue. Thus, make sure your campaigns all generate awareness and send the right message to your target market. If they do not, you might as well pull them out. As a rule, whether you have a large or small budget, you should strategize the most efficient campaign.

Before the internet and social media, small businesses would usually place ads on local newspapers and directories. Companies with bigger budgets spend on above the line ads such as TV commercials and billboards. But these days, almost every type of business takes advantage of social media platforms to reach their consumers. It’s also more cost-effective to maintain a social media page and website than pay for a billboard or TV commercial. Depending on the campaign strategy, other companies may employ both traditional and online advertising methods.

Either way, you should have an effective means to track if your campaigns are generating awareness. More importantly, if they have any impact on your sales. You can monitor this by checking analytics for pay-per-click ads. If your campaign has been on for a few months with hardly any improvements to your sales, it’s likely better to cancel them. Or perhaps you don’t need that many ads. At the end of the day, it’s a waste to keep paying for ineffective ads.

Another way to elevate your brand it to improve your reputation. Like they say, a good reputation is great advertising in itself. Thus, besides ads, focus on improving your customer service. When more customers are happy with your product and service, the more they will recommend your product to other people.

Travel and Transportation

Depending on your business, transportation and travel can take a big portion of your business expenses. But in certain situations, such as social distancing measures due to the COVID-19 crisis, traveling may be discouraged. Unless you need to transport certain goods, you might not have to do a lot of driving or traveling. Meeting clients may be a matter of taking a video conference call.

But in the event you need to travel, prioritize cutting costs. If you need to stay out of town for a business-related trip, take advantage of credit card reward points. You can also check hotel and airline loyalty promos. If you need to go on frequent trips, choose a more affordable hotel. Though business transport expenses are tax deductible, they still take cash before you can make claims. If you have large transportation costs, especially if you’re a small business, make sure to maximize your deductions.

Effective Marketing Strategies to Boost Sales

The primary way to reach BEP faster is to increase sales, which is no easy feat. This is why marketing is a challenging aspect of running a business. It involves planning strategies to promote customer awareness and boost sales. And beyond that, you want to engage potential consumers while cultivating a positive reputation in the industry.

Often, new business owners do not get the results they need by simply putting ads. Advertising is not the same as marketing. Remember that marketing is a process that entails planning and reaching goals. It engages potential consumers. The usual ad strategies won’t necessarily bring more clients or sales to your business. Besides ads and social media posts, here are several effective marketing practices that help increase sales.

Provide Free Workshops or Classes

People appreciate things that add value to their life and experiences. Let your business stand for something benefit-driven. Thus, try to offer classes or workshops related to your business. Then, make sure to cater to specific audiences. If you own a cake shop, host a baking class for moms and teens. If you’re in the printing business, host a talk about independent publishing for young writers. Be involved in your community. If anything, people appreciate learning for free. You can rent a venue at educational institutions such as a community college. Instead of just ads, holding these events will help people remember your brand on a positive light.

Join Local Business Organizations

Another way to get involved in your community is to join a local business network. Home-based business groups, in particular, are inexpensive to join. And these days, your town’s business group may even run their own active social media page. Get in touch with members and let them know a little more about you. Support from these groups can really be valuable. Once they know you, they can talk about your business and refer you to their friends and customers. Being part of a local business organization is also a good way to take part in cooperative marketing events. You can hold weekend markets or other holiday-driven events to boost sales.

Participate in Charitable Causes

You might have heard giving to charity boosts positive press. While it indeed does, keep in mind you’re doing this to help. It’s not just for a good reputation. Select causes you and your company really care about. Besides donating, take part in actual events these charities hold. If you’re advocating for environmental causes, you can participate as a sponsor at a non-profit event. While you’re at it, your business can start reducing plastic use and teach employees how to compost biodegradable waste. If you’re helping the local orphanage, you can provide a piggy bank jar for customers who want to donate loose change. This jar can go straight to orphanage donations every month. Again, being part of an advocacy involves actively engaging with your community.

Be Active on Social Media

Another good way to engage potential clients is by being active on social media. Depending on your business, you can stay connected with your consumers via Facebook, Instagram, or Twitter. These days, it’s definitely to worthwhile to invest in social media marketing. These platforms also allow you to target your intended customers. Social media can help promote events, post about promos and discounts, and create an image that is accessible for consumers. According to eMarketer.com, in 2021, around 91.9% of U.S. marketers in companies with over 100 employees were expected to use social media to market products and services.

Proactively Ask for Referrals

For the longest time, asking for referrals is one effective way to grow a business. It allows you to expand your network based on customers who have been satisfied with your service. While you may assume regular clients spread a good word of mouth, it still pays to proactively ask for referrals. In research done by Amplifinity, they found that verbal referrals produced the best results with a 32% success rate. If you’re not used to requesting referrals, make it a habit, most appropriately after completing a service. To encourage your customers, you can even make a referral program which offers discounts or gift checks. This should make customers more eager to refer family and friends.

What Types of Financing Do Businesses Rely On?

As mentioned earlier, determining your BEP can help you secure loans or persuade investors for your business. There are many various types of small business loans entrepreneurs can look into. This includes term loans, business lines of credit, and even equipment loans. Just remember that qualifications, rates, and terms vary per lender. This is also affected by the strength of your credit profile.

Depending on your needs, here are several small business loan options:

Term Loans

Term loans are some of the most common types of business financing. It’s ideal for business owners that have good credit and are looking to expand their company. It provides one-time lump sum funding for businesses.

Term loans can range from as small as $2,000 to as large as $5 million, while the rates play between 6% to 99%. You can obtain term loans from banks and online lenders. Banks typically provide lower term loan rates, but expect more stringent qualifications, such as a high yearly revenue and excellent personal credit score. They also provide longer terms up to 10 years.

Meanwhile, online lenders have looser requirements, but charge higher term loan costs. However, they provide faster upfront funding for businesses. Online lenders also offer short repayment terms, such as three months up to three years. Note that some lenders may require collateral such as property to guarantee financing.

SBA Loans

If you’re looking for a government-backed commercial loan, consider Small Business Administration (SBA) loans. These are issued by banks and other private lenders, but are guaranteed by the federal government. The SBA offers several different loan programs, such as 504 loans, 7(a) loans, and microloans.

The loan term depends on the type of loan and how you intend to use the money. If you’re planning to use it for real estate purchases, the repayment period is up to 25 years. For working capital, it can range for seven to ten years, while purchasing equipment can have a ten-year payment term.

SBA loans offer some of the lowest business loan rates in the market and long payment terms. It also allows you to borrow up to $5 million in business loans. However, expect a long and stringent qualifying process. This option is a good fit for borrowers with strong credit records. It works for business owners who want to expand their company or refinance existing debts. On the other hand, it’s not ideal for entrepreneurs who need funding right away.

Business Lines of Credit

Unlike a term loan that provides lump-sum funding, a business line of credit allows you to keep withdrawing and repaying your loan as often as you want, up to an approved limit. Lenders will allow you to repay your entire balance early, which lets you save on interest charges. Lines of credit also usually come with adjustable interest rates, unlike fixed-rates on term loans or SBA loans. It’s a flexible way to borrow cash as needed for your business.

On the downside, business lines of credit come with smaller limits, which range from $1,000 to $250,000. And because the limit is low, these are usually unsecured loans. Moreover, you don’t need any collateral such as real estate to secure financing. But note that some lenders may require you to put a personal guarantee or lien on your business assets. This gives the lender rights to go after your assets if you default on your loan.

If you get this loan option from a bank, expect them to require strong revenue and several years of business finances to qualify. If you need a larger line of credit, the bank will likely require collateral for finances. On the other hand, online lenders have more relaxed qualifications. But again, expect them to charge higher rates than traditional banks. Business lines of credit are suitable for short-term financing needs and handling business cash flow.

Equipment Financing

If you’re looking to purchase a specific machine or a truck for your business, consider taking an equipment loan. This type of financing provides some of the lowest interest rates, especially if you take your loan from a traditional bank. The loan amount you can borrow depends on the value of the equipment you need to buy. The equipment will serve as the collateral for financing, and the loan term should coincide with how long you expect to use the equipment.

Some banks may finance heavy-duty vehicles through equipment loans. But depending on your lender, some may require you to take semi-truck financing or a business auto loan. On the upside, you own the equipment right away and you can secure competitive rates if you have strong revenue and business credit. You are also eligible for tax deductions on the interest paid on your loan. It also comes with a depreciation tax benefit. On the other hand, buying the equipment may entail a hefty down payment. So make sure to save enough funds.

The Bottom Line

When a company breaks even, it’s reached a point where it does not have profits or loss. This is called the break even point (BPE), when a business’s revenue is equal to its expenses. To gain any profits, a business must exceed the BPE. For this reason, the BPE is an indicator for the time it takes for a company to become profitable.

There are two main business factors that impact BPE, these are fixed costs and variable costs. The fixed costs refer to necessary expenses such as rent or mortgage payments, utilities, marketing, research and development, etc. These are essential operational expenses that keep your business afloat even when you’re not producing goods. Meanwhile, variable costs are expenditures that increase when you raise your production. It includes the cost of raw materials and direct labor needed to produce a product. Generally, the higher the fixed and variable costs of a business, the higher the BPE.

Remember, BPE shows how soon your business can earn profits. If you don’t reach the BPE within the desired timeframe, you’re in danger of incurring losses. To reduce BPE and recoup expenses sooner, it helps to cut costs on fixed and variable expenses. Things like looking for an affordable office or warehouse to rent will decrease BPE. If you can find a supplier with a good deal on raw materials, it can also lower your BPE. Achieving a competitive price and upgrading the quality of your product will also boost sales, therefore reducing BPE. It’s a useful reference point that helps strategically price your products.

Change privacy settings