1031 Exchange Deadlines

1031 Exchange Deadlines

If you’re planning to perform a 1031 tax exchange, this calculator will help you determine both the 45 day and 180 day deadlines.

- 45 Day Deadline: You have to include prospective like-kind replacement properties prior to midnight on the 45th day after closing on your relinquished property sale transaction.

- 180 Day Deadline: You must finish your 1031 exchange (which includes the conveyance of title to all of your like-kind replacement properties) prior to

- midnight on the 180th day after closing on your relinquished property sale transaction, or

- by the due date of your federal tax return for the year the relinquished property was sold, including any extensions of time to file.

Enter the date you transferred your relinquished property and click on “Calculate Deadlines.” Your 45 day and 180 day deadlines will appear in the fields below.

Today's Beverly Hills Mortgage Rates

The following table shows current mortgage rates in Beverly Hills. Adjust your loan inputs to match your scenario and see what rates you qualify for.

Understanding 1031 Deadlines

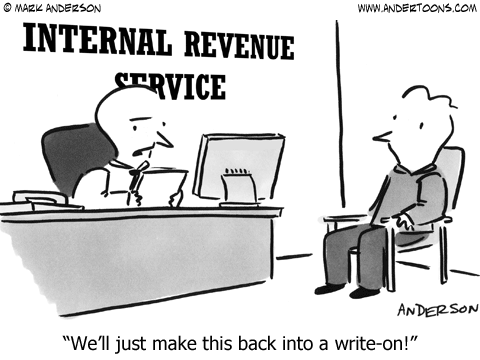

When you sell an asset and purchase a "like-kind" asset, you can defer taxes by declaring a Section 1031 or LKE (Like-Kind Exchange). Established in 1921 as part of the Internal Revenue Code, Section 1031 allows a taxpayer to reinvest the proceeds from a property sale and defer the capital gains taxes. This essentially allows certain taxpayers to benefit from an interest-free, no-term loan from the government, provided rules and stringent deadlines are adhered to.

Section 1031 applies to property used in a taxpayer's trade or business as well as property held for investment. It can occasionally apply to property used as a vacation home. It may also apply to other business assets, such as cranes, forklifts, trucks, and more.

Important 1031 Rules and Deadlines

The Internal Revenue Code requires a Qualified Intermediary (QI) to transfer the asset to the buyer and hold the cash until the replacement asset is acquired and the exchange is completed. Section 1031 rules clearly regulate that the taxpayer must not receive the proceeds or the exchange is disqualified.

- The taxpayer must identify a replacement property within 45 days after the original property or asset is transferred.

- Once the initial identification is made, the taxpayer has an additional 135 days (or until tax filing for that year) until taxes are due.

This allows initial taxes to be deferred for up to 180 days in total. The newly acquired asset may then be rolled into the next LKE as the original asset, further deferring taxes from gain and allowing gains to be invested in new assets. Missing the deadlines or failing to adhere to Section 1031 rules will result in being saddled with what is often a large tax burden.

Section 1031 Like-Kind Exchanges

There are several exchanges that can fit the Section 1031 deferral tax code:

- Simultaneous Exchange: Companies exchange like-kind assets with one another at the same time.

- Delayed Exchange: A gap occurs between the sale of an asset and the replacement of the asset. This is the most common type of LKE, and you will have up to 180 days to complete the exchange or pay the gains tax.

- Build-to-Suit (Improvement or Construction) Exchange: The newly purchased asset may be built on or improved with funds gained from the sale of the original asset.

- Reverse Exchange: You opt to purchase the replacement asset before the finalized sale of the original asset. The original asset may still be used by you until the exchange is finalized.

- Personal Property Exchange: An asset is exchanged for a like-kind or like-class asset. Assets may be similar, but not the same — like exchanging a forklift for a truck.

Deferring taxes allows you to retain your cash gained from the sale of your original asset. When invested repeatedly (as in the case of a real estate buyer), the taxable gains may continue to be deferred. Because there is no limit to the number of exchanges that may be done, taxpayers can roll exchanges together to maximize their cash flow benefit and indefinitely defer taxes typically paid on the gains.

Change privacy settings