HSA Contribution Calculator

HSA Contribution Calculator

Using this calculator, you can figure out how much you could be contributing to a Health Savings Account (HSA). From the pull-down menu, choose whether you are insuring just yourself or your family. After that, enter your annual deductible amount and the number of months your High Deductible Health Plan (HDHP) will be in force for the calendar year. Then indicate whether or not you’re over the age of 55.

Press CALCULATE, and you’ll see if your plan qualifies as an HDHP, the contribution you’ll be allowed to make to an HSA, and the catch-up amount allowed. You’ll also be provided with an amount for your total maximum annual and monthly contributions.

Reference: For a full description of HSAs please refer to IRS Publication 969 (2017), Health Savings Accounts and Other Tax-Favored Health Plans.

Your Complete Guide to Health Savings Account Contribution Limits

Rising health care costs have sent many Americans scrambling to find some relief in reasonably priced insurance. Mandates from the Affordable Care Act (ACA) have also caused renewed interest in shopping for primary health care plans and supplemental options.

The mad dash for affordable insurance isn't just reserved for employees; employers are grappling with expensive increases and passing higher deductibles on to their workers. According to reports, large companies are estimating a 6.5 percent rise in health care costs in 2015. Those companies are offsetting the increases, and passing them on to employees, by offering health plans with high deductibles and low monthly premiums.

An employee might be discouraged by the higher deductibles. However, these high-deductible health plans (HDHPs) do offer at least one benefit for employees: the health savings account, or HSA.

What are the Benefits of Health Savings Accounts?

An HSA is a tax-exempt or custodial account set up with a U.S. financial institution to save money exclusively for future medical expenses. Created in 2004, HSAs can only be used along with HDHPs. As the number of employers offering HDHPs continues to increase, more employees will have the opportunity to set up an HSA.

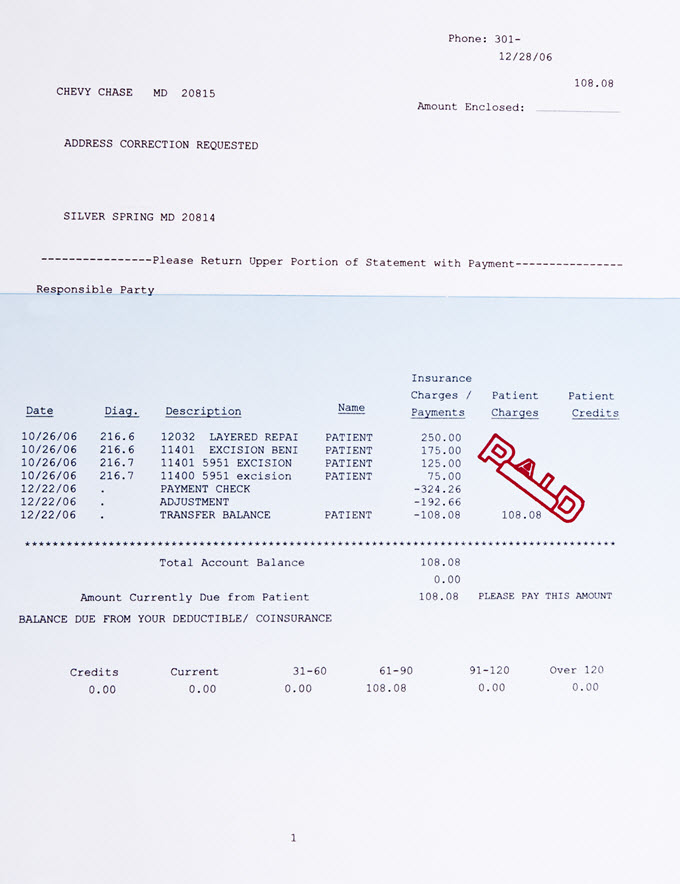

One key benefit of an HSA is that it offers cash that can come in handy for qualified medical expenses, including copays, prescription drugs, and emergency care. Depending on the banking institution, HSA account holders might receive debit/credit cards linked to their account for out-of-pocket expenses.

The IRS list several other benefits of having an HSA, including:

- Interest and other earnings of the account are tax-free.

- Distributions are tax-free when you pay for qualified medical expenses, which are typically the same expenses that would qualify for your medical and dental expense deductions.

- You can claim a tax deduction for contributions that you, or someone besides your employer, make to your HSA.

- Your employer's contributions to your HSA doesn't have to be included in your gross income.

- Contributions to your HSA account stay until you decide to use them, even if you are no longer contributing to the account.

- You can keep your same HSA even if you get a new job or leave the workforce.

To qualify for an HSA, in addition to being covered under an HDHP you cannot be enrolled in Medicare, claimed as a someone else's dependent, or have any other health coverage.

How do Health Savings Account Contribution Limits Work?

HSAs offer flexibility in who can give to the account. Any eligible person can set up and contribute to an HSA, regardless of whether they are unemployed, self-employed, or work for a company. Employers can contribute to their employees' HSAs as well, and many companies host matching programs.

Any contribution to an HSA account must be made in cash; stock or property are not allowed as contributions.

Contribution limits to HSA accounts will increase in 2015. If you are an individual only covering yourself, the limit increases to $3,350, up from $3,300 in 2014. If you are an individual with family coverage, the limit is $6,650, which is up from $6,550.

Contribution limits may vary based on age, which is an advantage for seniors. If you are an eligible person who is 55 years of age or older at the end of the tax year, your contribution limit increases by $1,000.

Here are factors that affect your HSA contribution limits:

- The type of HDHP coverage you have

- Your age

- The date you became eligible for an HSA (which determines which year's limits you have to follow)

- The date you are no longer eligible for an HSA

It's important to note the date you became eligible for the HSA to truly understand your contribution limits. Under a guideline called the last-month rule, if you are eligible on the first day of the last month of your tax year, you are still considered eligible for the entire year and must adhere to the tax limits set for that year.

How do I Determine How Much I can Contribute to my HSA?

You decide how much you can put toward your HSA by examining your pay versus your expenses. One helpful online tool is the above HSA contribution calculator, which asks about your type of health plan, your annual deductible amount, and the amount of time your HDHP will be in force.

HSAs have become viable options for workers facing increasing health care costs. More people are expected to take advantage of HSAs in the coming years. The account's flexibility offers some benefits to employees who pay higher deductibles but are at least able to put money away for out-of-pocket expenses.

Change privacy settings